The Minorities Approach

Our Investment strategy

We syndicate with validated co-investors in propretarily sourced companies with high potential.

Outperforming sectors

- Technology, the life sciences, and the energy transition are the core sectors in our strategy.

- All three sectors benefit from strong structural drivers and have outperformed the market over the past decades.

Top tier co-investors

- Our network of top-tier co-investors provides access to attractive and exclusive opportunities.

- Co-investing with proven investors creates opportunities for significant value-add.

Value-driven mission

- All companies must have an impact on people or planetary health through their operations.

- ESG is a central and integrated investment criteria.

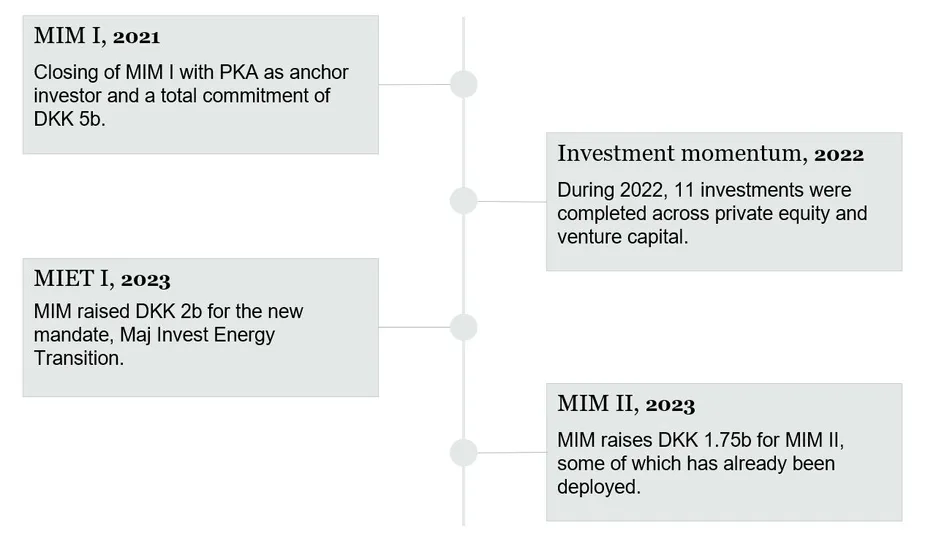

Timeline for Maj Invest Minorities

Since its establishment in 2021, Maj Invest Minorities has gained significant traction both domestically and abroad. Our strategy has proven successful, leading to a substantial influx of deals and a demand for further expansion.

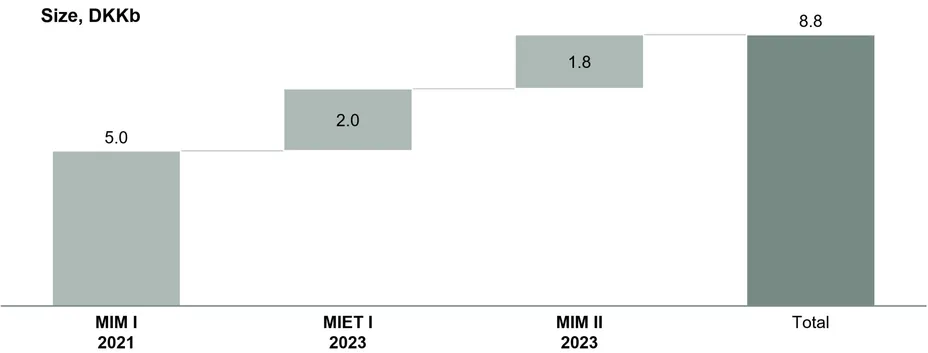

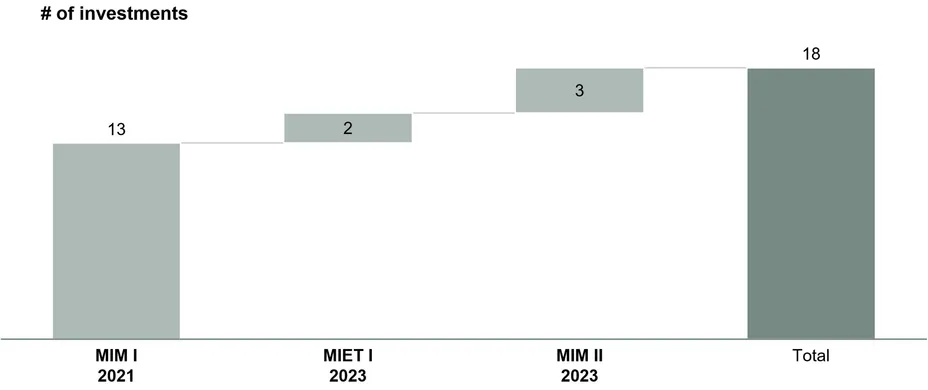

Our funds

Maj Invest Minorities manages three funds across two complementary strategies with a total AUM of ~8.8 billion DKK. Maj Invest Minorities is focused on investments in high-growth PE and VC companies within technology and the life sciences with a strong ESG profile. Maj Invest Energy Transition targets exposure to the green energy transition.