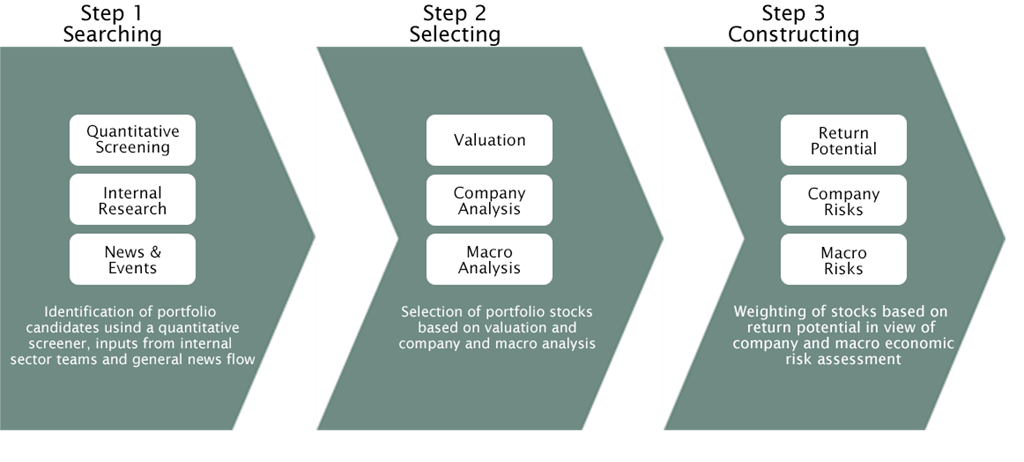

Maj Invest follows a proprietary process in order to achieve our investment objectives.

The process is implemented in three steps. The first step is a quantitative screening model based on which the investment team discusses and shares ideas with other Maj Invest portfolio managers and the sector teams. At this stage of the process, the investment team is open to all insights that may identify a genuine portfolio candidate. All equities are evaluated via a proprietary screening process with regard to their relevant valuation metrics. This screening process narrows down the universe to around 100 investment ideas before being considered for further analysis in the second step of the process.

The second step represents the fundamental part of the process where research is conducted to fully understand the companies, their industries, business models, their management and valuations. The team analyses the available annual reports and other relevant external material in order to understand the economic model behind the company. During this step we attach great importance to significantly undervalued companies as measured by financial ratios. Our working hypothesis is that “it is far better to be approximately right than to be precisely wrong”.

In the third step we look at a possible inclusion into the portfolio of 25-35 equities by evaluating the potential return, specific company and related risk as well as the relevant macro risk environment.

All equities in the portfolio are also monitored regularly for developments in the competitive landscape or for example changes in management in addition to being assessed on their valuation metrics. By doing so only relatively cheap equities are allowed entry into the portfolio, and investments in expensive or fairly valued equities are either reduced or divested entirely.

Read more about our philosophy or see our team.